The Solar Investment Tax Credit

As countries prepare for the upcoming United Nations Climate Change Conference (COP21) on November 2015, the United States has made tremendous steps to fight global warming, such as signing bilateral agreements with China and Brazil to reduce their CO2 emissions. The U.S. has also made big changes at the domestic level, especially in the use of renewable sources in its electricity sector.

To promote the use of more cleaner and sustainable energy sources in the electricity system, the U.S. government created the Solar Investment Tax Credit (ITC), a 30% federal tax credit for the installation of solar systems in the U.S. The ITC credit is given to both residential and commercial customers that install solar panels (primarily photovoltaics [PV]) in their business or homes to generate electricity. Established in 2005 (although regulation were not in placed until 2010), the tax credit has given the American solar sector a large boost, with the number of megawatt (mW) PV installations increasing over 4,000% from 2006 to 2013.

A tax credit is the primary policy incentive used by the United States to promote new technologies, and its use to promote renewable energy is no exemption. Through this method, the U.S. government is able to incentivize the private sector into using a new technology at a faster rate, exponentially changing a sector’s landscape. Similarly, a tax credit is already a tool familiar to not only companies, but also politicians and individual citizens, making it easier to pass and regulate.

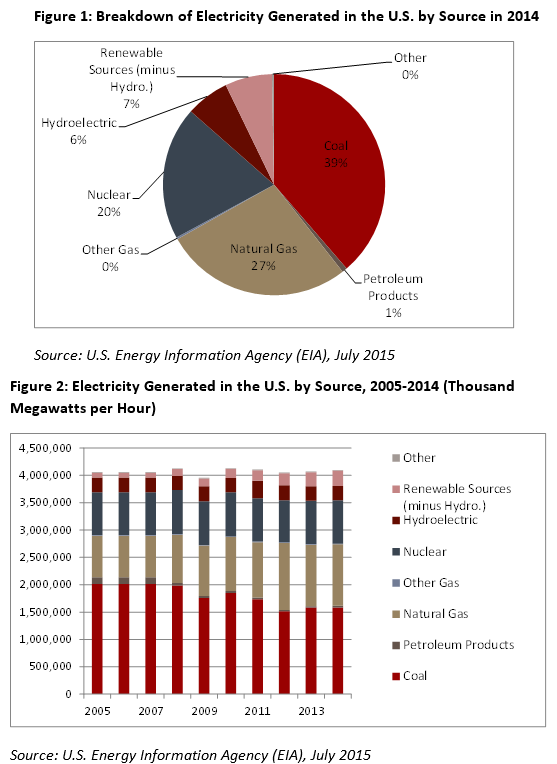

The ITC tax has been critical for the use of renewable sources on the American electric sector. In 2014, renewable energy sources (solar and other) make up 7% of the total electricity generated in the United States. This is a small percentage compared to coal (39%) and natural gas (27%), which are the primary sources of the electricity produced in the country (Fig 1).

Since the introduction of the ITC in 2005, the market share of solar and other renewables within the electric system has expanded by 222% (Fig 2). Generation through solar sources (either PV or thermal), has expanded over 3,000% from 2005 to 2014, generating 550 thousand mW/Hr in 2005, and reaching around 18,000 thousand mW/Hr in 2014 (Fig 3). PV generation was the main benefactor of the ITC tax, with its share of production exploding in 2008, when it reached 375%, and has continued to drastically increase over the past 6 years (Fig 4).

The increase use of renewable energy sources to generate electricity has made the American grid more sustainable and clean, a critical step for the U.S. lowering its CO2 emissions. According to the EPA, in 2013 the electricity sector was the largest source of Greenhouse Gas (GHG) emissions, making up 31%. This is due to the fact that coal remains the primary source of electricity in the United States (see Fig 2 above). The exponential growth of the solar energy sector caused by the ITC tax would allow the U.S. to lower its use of coal as a source for electricity, lowering its GHG emissions and its reliance on a finite resource.

This is also a significant step towards energy sustainability for the U.S. PV panels have low CO2 emissions, with an average of 100 grams of CO2 equivalent kW/h. Most of the CO2 emissions for PV platforms are in the manufacturing stage, when the installations are built. In contrast, coal’s average CO2 emission is ten times PV. Similarly, PV land use is small, calculated at around 28-64 km2per tW/h, 92% less land area than hydroelectric plants, which needs 750 km2 per tW/h. Finally, solar technology (particularly PV) will help the United States become more energy self-sufficient, lowering the need to import fossil fuels for internal consumption.

Obstacles

Although the ITC has been essential for the boost in solar-generated electricity, it remains a luxury item, especially for residential owners. Although the 30% credit is given to either residential or commercial users, only those that have the tax liability can take advantage of the ITC. As the ITC is a dollar-to-dollar credit, it means that individual residential owners need to have the capital to install solar panels to receive the ITC credit. This limits the number of residential owners that can install solar panel, as the average cost ranges between US$15,000 and US$24,000. Although it is natural that a new technology such as solar installations is driven by private companies and wealthier individuals, its future depends heavily on its usage by the middle class. Given that installation cost remains high (despite the fact that cost has dropped by 73% since 2006), the average American residential owner is unlikely to install their own solar panel.

A final obstacle is the fact that the ITC is scheduled to be significantly reduced by 2017, with the credit dropping from 30% to 10% for commercial purposes, and to zero for residential owners. This would lower the incentive for business to install solar panels in their buildings, while completely halting residential installations. Furthermore, the ITC is one of the remaining credits left for solar installations as state level incentives have been under scrutiny at the state and local level since the Great Recession. The elimination of the ITC could set back renewable energy in the U.S., which could increase the use of more non-renewable sources and hampered any efforts at energy sustainability.

They Way Forward

The best way to move forward for the U.S.’ solar sector is to renew or make permanent the ITC. President Barack Obama proposed making the ITC permanent in its 2016 budget. However, the President’s proposal are likely to find opposition in the Republican-dominated Congress, which already fought and the production tax credit, a credit similar to the ITC for the wind industry.

States can also provide more incentives for solar usage. Most states already provide multiple incentives, while the largest states (such as California, New York and Illinois) leading the charge. However, resistance remains in significant states, such as Texas, where efforts to promote significant solar incentives (particularly tax exemption) have failed at the state level.

Making the ITC permanent would continue to boost the United States’ use of solar energy and lower the country’s GHG emissions. The ITC would continue to promote sustainable energy as American use less non-renewable sources in their energy matrix. Furthermore, the ITC has made solar energy a viable opinion, increasing its visibility within the American public and expanding the changes of the U.S. signing (and ratifying) a global agreement in Paris later this year.

References

1. ‘Global Climate Pact Gains Momentum as China, U.S., and Brazil Detail Plans’, New York Times, June 30, 2015, https://www.nytimes.com/2015/07/01/world/americas/us-and-brazil-agree-on-climate-change-actions.html

2. ‘Solar Investment Tax Credit (ITC)’, Solar Energy Industries Association, July 12, 2015, https://www.seia.org/policy/finance-tax/solar-investment-tax-credit

3. Comello, Stephen D., and Stefan J. Reichelstein. “The US Investment Tax Credit for Solar Energy: Alternatives to the Anticipated 2017 Step-Down.” (2015).

4. Bloom, Nick, Rachel Griffith, and John Van Reenen. “Do R&D tax credits work? Evidence from a panel of countries 1979–1997.” Journal of Public Economics 85.1 (2002): 1-31.

5. ‘Sources of Greenhouse Emissions’, U.S. Environmental Protection Agency, July 12, 2015, https://www.epa.gov/climatechange/ghgemissions/sources/electricity.html

6. Evans, Annette, Vladimir Strezov, and Tim J. Evans. “Assessment of sustainability indicators for renewable energy technologies.” Renewable and sustainable energy reviews 13.5 (2009): 1082-1088.

7. Cooper, Richard N., and William A. Pizer. “[A Robust Strategy for Sustainable Energy]. Comments and Discussion.” Brookings Papers on Economic Activity (2005): 270-284.

8. Evrendilek, F., and C. Ertekin. “Assessing the potential of renewable energy sources in Turkey.” Renewable Energy 28.15 (2003): 2303-2315.

9. Mendonça, Miguel, Stephen Lacey, and Frede Hvelplund. “Stability, participation and transparency in renewable energy policy: Lessons from Denmark and the United States.” Policy and Society 27.4 (2009): 379-398.

10. Yang, Chi-Jen. “Reconsidering solar grid parity.” Energy policy 38.7 (2010): 3270-3273; ‘Cost of Solar Power’, Sunrun, July 12, 2015, https://www.sunrun.com/solar-lease/cost-of-solar

11. ‘Solar Industry Breaks 20 GW Barrier – Grows 34% over 2013’, Solar Energy Industries Association, July 12, 2015, https://www.seia.org/research-resources/solar-industry-data

12. Mendonça, Miguel, Stephen Lacey, and Frede Hvelplund. “Stability, participation and transparency in renewable energy policy: Lessons from Denmark and the United States.” Policy and Society 27.4 (2009): 379-398.

13. ‘Will Solar Plunge Off the Tax Credit Cliff?’, Renewable Energy World, February 20, 2015, https://www.renewableenergyworld.com/articles/2015/02/will-solar-plunge-off-the-tax-credit-cliff.html

14. ‘Obama proposes permanent extension of solar’s ITC’, PV Tech, February 02, 2015, https://www.pv-tech.org/news/obama_to_propose_permanent_extension_of_solars_itc_according_to_reports

15. ‘Production Tax Credit for Renewable Energy’, Union of Concerned Scientists, July 12, 2015, https://www.ucsusa.org/clean_energy/smart-energy-solutions/increase-renewables/production-tax-credit-for.html#.VaKzj_kYmDl

16. ‘Texas Tax Code Incentives for Renewable Energy’, Texas State Energy Conservation Office, July 12, 2015, https://seco.cpa.state.tx.us/re/incentives-taxcode-statutes.php